Table Of Content

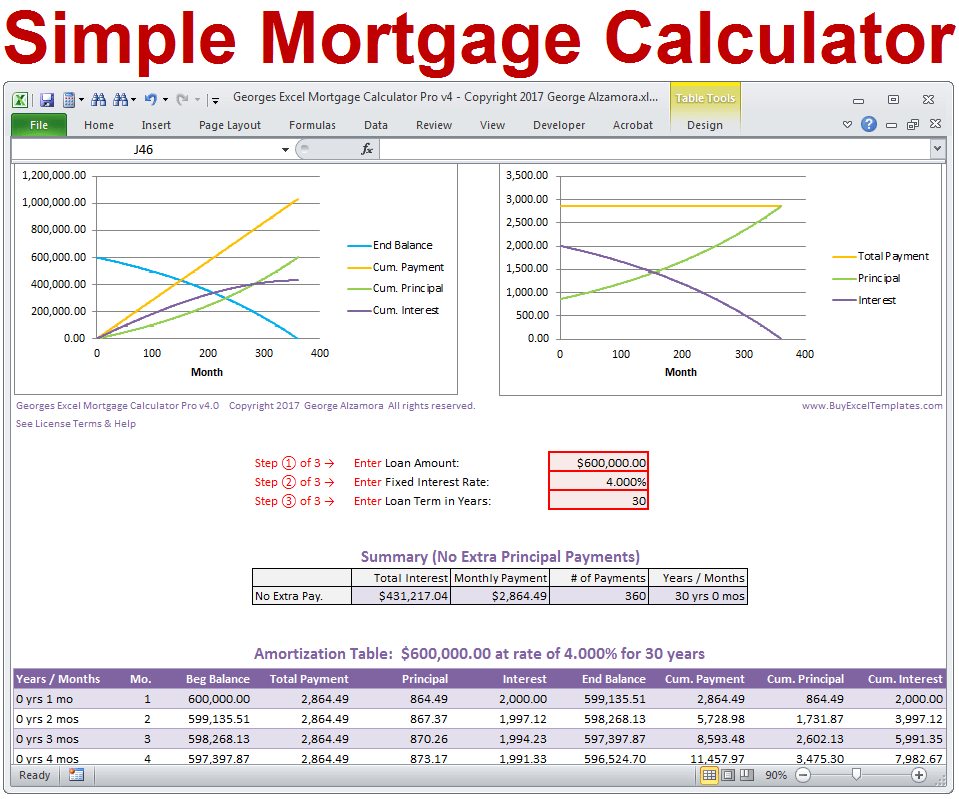

For more information about or to do calculations involving depreciation, please visit the Depreciation Calculator. This mortgage payoff calculator helps evaluate how adding extra payments or bi-weekly payments can save on interest and shorten mortgage term. Need to generate an amortization schedule for a 30 year fixed-rate conventional loan?

How Are Mortgage Rates Determined? A Comprehensive Look At Mortgage Interest Rates

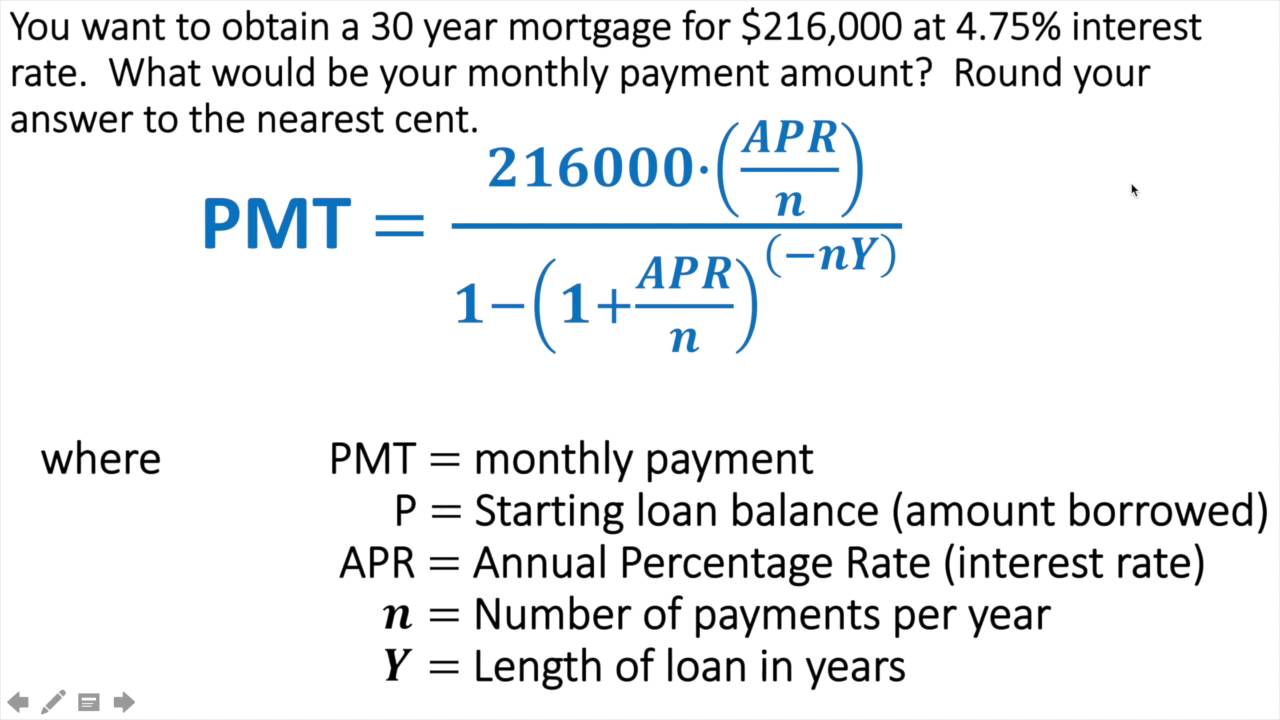

If the down payment is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater. Use the mortgage calculator to get an estimate of your monthly mortgage payments. When you make your monthly mortgage payment, part of your payment will go toward interest and the rest will be applied to the principal. In the beginning, most of your monthly payments will go toward interest.

Conforming loans vs non-conforming loans

Down Payment on a House: How Much Do You Really Need? - NerdWallet

Down Payment on a House: How Much Do You Really Need?.

Posted: Fri, 12 Apr 2024 07:00:00 GMT [source]

For example, for that same $200,000 house with a 4.33 percent interest rate, your monthly payment for a 15-year loan would be $1,512.67, but you would only pay $72,280.12 in interest. You would also pay off your loan in half the time, freeing up considerable resources. A mortgage is often a necessary part of buying a home, but it can be difficult to understand what you can actually afford.

Estás ingresando al nuevo sitio web de U.S. Bank en español.

But some courses have popped up online which cost more than £1,000. "It's happened on so many occasions, like four, five times," he said. Overtime protections have been a critical part of the FLSA since 1938 and were established to protect workers from exploitation and to benefit workers, their families and our communities. Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid. Some intangible assets, with goodwill being the most common example, that have indefinite useful lives or are "self-created" may not be legally amortized for tax purposes. Writers and editors and produce editorial content with the objective to provide accurate and unbiased information.

A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price, down payment, interest rate and other monthly homeowner expenses. The mortgage payment estimate you’ll get from this calculator includes principal and interest. If you choose, we’ll also show you estimated property taxes and homeowners insurance costs as part of your monthly payment. Now that you know your mortgage options, the next step is to stay on top of your monthly payments. When borrowers get conventional loans, they usually take 30-year fixed-rate terms.

Explore mortgage options to fit your purchasing scenario and save money. Lenders use your debt-to-income (DTI) ratio to decide how much they are willing to lend you. DTI is calculated by dividing your total monthly debt — including your new mortgage payment — by your pretax income. The mortgage calculator estimates a payment that includes principal, interest, taxes and insurance payment — also known as a PITI payment.

Mortgage calculator

Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Adjust the loan details to fit your scenario more accurately. As for the downpayment, most lenders require 20 percent of the home’s value.

For example, you can’t negotiate on the property taxes in your state, but you can always try to negotiate a lower price on your home. Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage you’re required to purchase may vary by location. For example, if you live in a flood zone or a state that’s regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires. A long-term mortgage is a loan with a shorter length of time.

Interest rate

Defaulting on a mortgage typically results in the bank foreclosing on a home, while not paying a car loan means that the lender can repossess the car. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures.

It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. Today, both entities continue to actively insure millions of single-family homes and other residential properties. Most people use a mortgage calculator to estimate the payment on a new mortgage, but it can be used for other purposes, too. In addition, the calculator allows you to input extra payments (under the “Amortization” tab). This can help you decide whether to prepay your mortgage and by how much. When a loan exceeds a certain amount (the conforming loan limit), it's not insured by the Federal government.

But over time, more and more of your money will go toward principal. Mortgage loan terms can vary, but most borrowers choose either a fixed-rate 15-year or 30-year mortgage. You can adjust your monthly mortgage payment by changing the loan terms.

How Much Is A Down Payment On A House? - Bankrate.com

How Much Is A Down Payment On A House?.

Posted: Tue, 09 Apr 2024 07:00:00 GMT [source]

Extra payments can possibly lower overall interest costs dramatically. For example, a one-time additional payment of $1,000 towards a $200,000, 30-year loan at 5% interest can pay off the loan four months earlier, saving $3,420 in interest. For the same $200,000, 30-year, 5% interest loan, extra monthly payments of $6 will pay off the loan four payments earlier, saving $2,796 in interest. Extra payments are additional payments in addition to the scheduled mortgage payments. Borrowers can make these payments on a one-time basis or over a specified period, such as monthly or annually. The U.S. Department of Agriculture provides home financing for low to moderate income families.

Many borrowers frequently take conforming conventional loans with 15 or 30-year fixed-rate terms. Lenders also offer them in 10-year, 20-year, and 25-year payment terms. Homebuyers and refinancers can use the filters at the top of the table to see the monthly payments and rates availble for their loans. Just like you have to carry insurance for your car, you have to carry insurance for your home. This protects you and the lender in case of a fire or other catastrophic accident.

In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services. Getting approved for a loan with Rocket Mortgage tells you exactly how much of a loan you can qualify for.

No comments:

Post a Comment